The future of electricity rate plans and Guarantee that rate structure reflects cost structure

Electric utilities are seeing their industry changed. Sustainable portfolio guidelines, nonutility generators of inexhaustible electricity, net metering, behind-the-meter stockpiling, and other dispersed energy arrangements have drawn incomes and clients from conventional utilities and made a bungle between Energy Rates and utility expenses. In the long haul, strategy and innovation patterns, generally prodded by decarbonization, could keep on spurring clients to diminish their reliance on or even leave customary utilities for outsider providers.

Truly, electricity rate structures have packaged all-electric administrations into one volumetric rate charging clients by kilowatt-hour of utilization served all significant partners’ targets. Clients inside a similar rate class (business, mechanical, private) got a similar degree of administration and comprehended that their electric bills fluctuate depending on the measure of electricity they utilized. Utilities recuperated their expenses and capital speculations without huge rate increments. Policymakers enjoyed that volumetric rates empowered energy effectiveness. Furthermore, with few substitute alternatives for clients, the framework was steady.

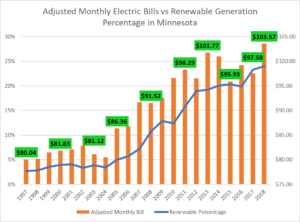

Today, against the setting of decarbonization, expanding client complexity, and new contests, utilities’ fixed expenses are expanding. Lattice modernization and ventures to meet manageability objectives come at a huge capital cost. As a bigger portion of electricity is sourced from renewables, utilities should guarantee sufficient framework adaptability to keep up with unwavering quality when supply from renewables is irregular or low. With volumetric rates, mounting fixed expenses are given to clients who enjoy not taking benefit of decentralized, outsider exchange openings, (for example, net metering or behind-the-meter stockpiling). Clients discover their bills befuddling thus, unfit to comprehend why their bills are expanding regardless of restricted changes in their utilization and level of administration.

Except if utilities update their evaluating and contributions, they will wind up with a contracting base of clients among which to appropriate increasing expenses. With administrative cycles that can last years, rate-plan change should begin today if utilities desire to resolve the issues coming in the following decade.

Guarantee that rate structure reflects cost structure

With the reception of renewables developing, repaired costs make up an extending portion of the expense of financing the network. In contrast to the petroleum product age, renewables have no fuel costs and somewhat negligible activity and upkeep costs. Renewables are likewise irregular force sources, which requires expanded framework adaptability. Accordingly, utilities have made huge capital uses to redesign lattice resources to give unwavering quality, adaptability, and security. As a groundbreaking business, modern, and private clients make the most of chances in appropriated energy, for example, housetop sun powered and behind-the-meter stockpiling, the leftover volumetric clients are passed on to bear an outsize measure of the developing fixed expenses related with these framework wide changes.

Utilities could cure the inconsistency by coordinating with a fixed-charge part (a set month-to-month expense) and an interest charge segment (an instalment for every kilowatt top) to real framework costs. These rate segments are now important for some business and mechanical rates and, less significantly, private rates. In any case, the rate parts don’t mirror their expenses for the framework. Precisely reflecting framework level expense breakdowns will spur conveyed age, behind-the-meter stockpiling, and other circulated energy assets (DERs) where they are monetarily effective.

Think about the administrative reaction to any proposed changes to rate structures. Ongoing experience has shown that utility commissions ordinarily reject enormous expansions in fixed and request charges. Notwithstanding, numerous utilities have seen a good outcome with little expansions in these charges, which can steadily adjust rates to costs.